File Your TDS Returns

TDS Return is required to be filed by any person who is liable to deduct tax at source. A TDS Return is a quarterly statement which has to be submitted to the Income Tax Department of India.

How To Pay TDS Payment Online

file for TDS return on time. Finnsdom assists and guides you on online TDS return in 3 easy steps:

File Your TDS Returns

Documents Required from Directors, Shareholders

- Pan Card Copy (Mandatory)

- ID Proof (Any one) – Driving License/ Voter ID/ Passport Copy/ Aadhaar Card

- Address Proof – Latest Bank Statement/ Latest Telephone or Mobile Bill/ Latest Electricity Bill.(MUST be less than 30 days old)

- Passport Size Photograph

Documents Required for Registered Office Address

- NOC – No Objection Certificate from the Owner of the Property

- Address Proof – Latest Telephone Bill or Mobile Bill/ Gas Bill/ Electricity Bill (MUST be less than 30 days old)

File your TDS Return Online - An Overview

Online TDS return is a statement given to the IT department every quarter. It is essential for every deductor to deposit income tax and file for TDS return on time.

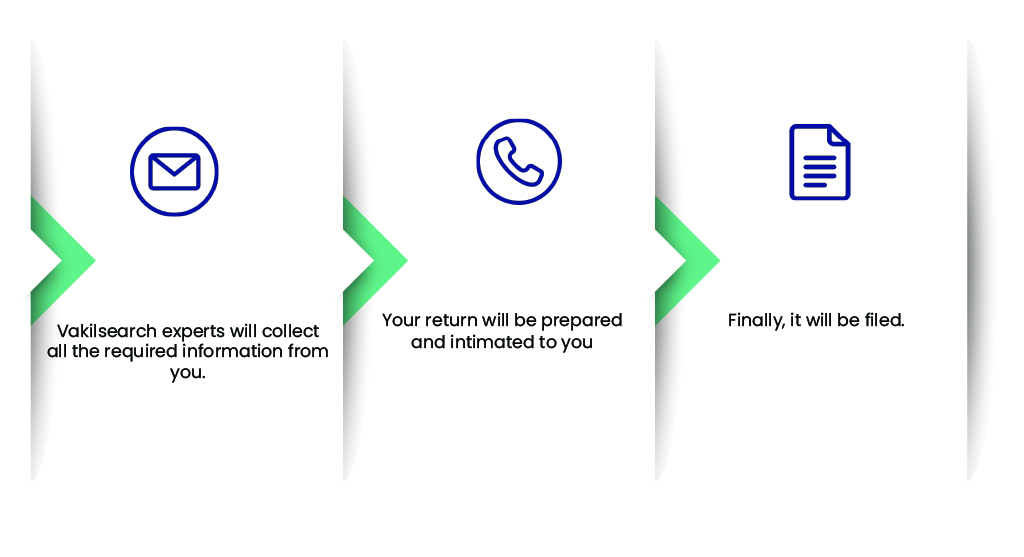

Finnsdom assists and guides you on online TDS return in 3 easy steps:

- Information Collection

- Our agents will set up a seamless process for data collection

- Return Preparation

- Your return will be prepared as required

- Return Filing

TDS Return for individuals and businesses

- Salary

- Insurance commission

- Income from winning horse races

- Income by way of “Income on Securities”

- Income by way of winning the lottery, puzzles, and others

- Payment in respect of National Saving Scheme and many others

An assessee can submit an e-TDS return if the same was deducted from their income. As mentioned earlier, it is the obligation of the assessee to file within the due date or be liable to pay a penalty for delay. The categories of assessees eligible to electronically file TDS returns every quarter are:

- Company

- Persons whose accounts are audited u/s44AB

- Persons holding an office under the Government

Benefits of TDS Return Filing Online

- A steady inflow of income to the government.

- Facilitates a smooth collection of taxes used for welfare.

- No burden of paying tax lump sum as the payment is done every three months for the whole year

How do we help in Filing TDS returns?

It is mandatory for every deductor to submit a TDS return to the Income Tax Department of India in quarterly statements. Every detail of the returns has to be accurate and precise. Keeping up with the quarterly payments can be cumbersome and if not done on time, you may attract huge penalties.

The rate of TDS is set by the IT department based on expenses recognized by them. Hence the prescribed rate of the deduction varies. Keeping the threshold limit in mind while making payments can be tedious.

Once you choose us, our affiliates prepare the account and file a TDS refund on your behalf. From the very first stage of preparing the returns till the last phase of the refund, we act as your consultants. Finnsdom not only does all the paperwork for you but also makes sure that every government interaction is smooth. Our process is truly transparent and always meets your expectations.

We take care of:

- Computing your TDS payments

- e-filing the TDS return

- Adherence to compliance with regulations

Things to remember before Filing TDS Return on time

For any person who has a TDS reduction in their pay, a TDS return can be filed online. Return preparation has to be done within the prescribed time frame because for individuals who are deemed as regular defaulters in India, a grave penalty can be charged. Therefore submitting an e-TDS Return in the prescribed time is essential.

For the deductor, it is vital to deposit the subtracted TDS to the concerned government department along with the details.

The time period within which the deductor should deposit the amount and the deductee has to file for a TDS refund is given below. It is important to stick to the schedule to avoid incurring a penalty.

For online TDS returns, every single person who has made the TDS deduction should file the TDS return without fail. The deductor should make the quarterly submissions at the Income Tax department. There are different types of forms available in accordance with the change in the intent of the TDS deductions made. The PAN details of both the deductees and the deductor should be added to the statement. The statement should also contain information about the TDS challan and the tax details among other important details.

In an online TDS return, the statement/ TDS return is defined as the summary of every transaction made in relation to the quarterly TDS payments. This statement should be submitted by the deductor to the department of income tax.

For all deductors, the submission of a TDS returns is mandatory. It contains the details of TDS deductions and deposits made by the deductor. It should also contain PAN card details of both deductees and deductor, tax paid particulars, information about TDS challan and any other extra information the form demands.

Filing Revised TDS Returns

In the case of online TDS return, if there are any errors committed due to incorrect challan details, incorrect PAN details or lack of PAN card details, the amount which is credited as the tax will not be reflected in the Form 16A/Form16/Form 26AS. In such cases a revised TDS return must be filed.

To file a revised TDS return, you need two files – consolidated file containing the details of the deductions made in the quarter; and the one is the justification report containing the information on the errors filed in the return.

The period of filing the TDS refund

While filing online TDS returns, if you pay in excess of the actual tax amount payable, you will be eligible to claim a TDS refund.

The time within which the refund is done depends on whether you have made the income tax return filing before or after the due date. In case the returns were filed on time, then you will receive the refund of the excess amount within 3-6 months.

In online TDS return, if there is a case of late filing or failure to file the returns, the individual or the company will have to face two types of penalties:

- The late filing fee- U/s 2 and 234E

- Non-filing penalty – U/s 271 H

Due dates for online TDS Return Submission

A TDS return has a time frame same as a tax payment. Though the return can be filed online, there is a due date for each quarterly submission. To ensure you are ahead of the deadline, Finnsdom Google Calendar has predefined compliance dates marked for every month. You will be receive a notification of the approaching due date well in advance and never incur a penalty for missing it.

Documents required to file TDS Return online

The following documents have to be submitted for filing the TDS returns.

- TAN details

- PAN details

- Last TDS filing details, if applicable

- The period for which TDS has to be filed

- Date of incorporation of the business

- No. of transactions for filing TDS returns

- Name of the entity – Proprietorship/ Partnership/ Company/ LLP

Get Started at

₹ 499/-

FAQ's On File Your TDS Returns

It is the duty of the person who is making payment to someone for specified goods or services to deduct TDS and file TDS return. The specified payment includes salary, interest, commission, brokerage, professional fees, royalty, contract payments, etc. The person who deducts TDS is called deduct or and the person whose tax is being deducted is called deducted. TDS is not required to be deducted by Individuals and HUF.

While paying TDS, e - payment is the compulsory process.

TAN is an alphanumeric 10-digit number required by a person who is liable to deduct TDS and file TDS return. Thus such a person must make an application within a month of deducting TDS for allotment of Tax Deduction and Collection Number (TAN) in Form 49B. This number allotted is mandatory to mention in all TDS Certificates issued, returns, challans etc. If a person fails to apply for TAN he may be penalized up to Rs. 10,000/-.

Payment can be done using net banking online on NSDL by selecting Challan 281. The TDS payments should be made before filing the TDS return. e-payment is compulsory for all Corporate assesses and non-corporate assesses who are liable for audit u/s 44AB. Physical payment can be made using Challan 281 in an authorized bank branch.

Yes. It is mandatory for deductors and employees to submit their PAN as well.

Following are the basic duties of any individual who is liable to deduct tax at source.

• He shall obtain Tax Deduction Account Number and quote the same in all the documents pertaining to TDS.

• He shall deduct the tax at source at the applicable rate.

• He shall pay the tax deducted by him at the source to the credit of the Government (by the due date specified in this regard*).

• He shall file the periodic TDS statements, i.e., TDS return (by the due date specified in this regard*).

• He shall issue the TDS certificate to the payee in respect of tax deducted by him (by the due date specified in this regard*). *Refer tax calendar for the due dates.

PAN of the deductor has to be given by non-Government deductors. It is essential to quote PAN of all deductees.