GST Returns Filing Made Easy

Is GST returns filing taking up your time and giving you a headache? Our GST filing package is the perfect solution for you!

GST Returns Filing With Finnsdom

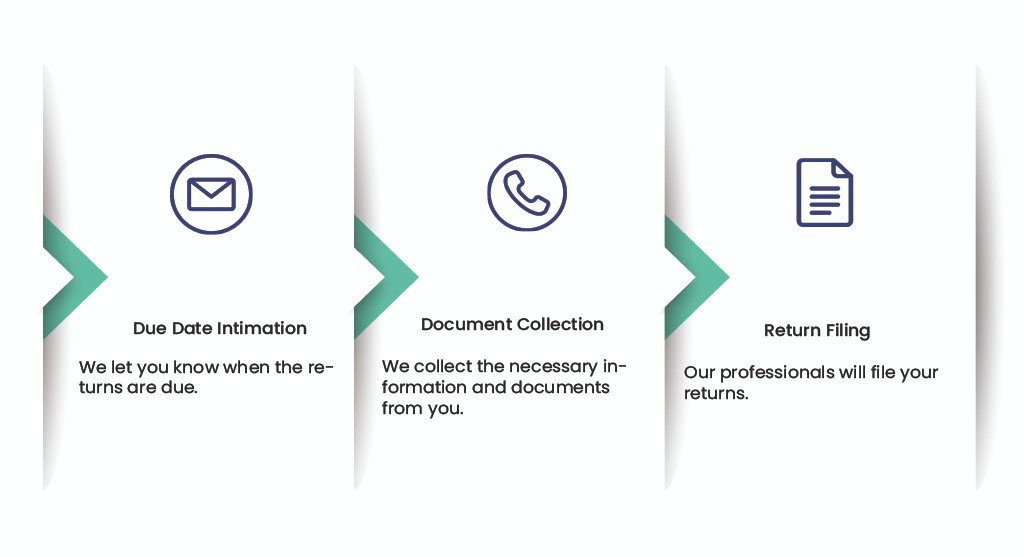

It is mandatory for every taxpayer registered under GST to file GST returns. It can be done in 3 simple steps with Finnsdom

GST Returns Filing Made Easy

Documents Required from Directors, Shareholders

- Pan Card Copy (Mandatory)

- ID Proof (Any one) – Driving License/ Voter ID/ Passport Copy/ Aadhaar Card

- Address Proof – Latest Bank Statement/ Latest Telephone or Mobile Bill/ Latest Electricity Bill.(MUST be less than 30 days old)

- Passport Size Photograph

Documents Required for Registered Office Address

- NOC – No Objection Certificate from the Owner of the Property

- Address Proof – Latest Telephone Bill or Mobile Bill/ Gas Bill/ Electricity Bill (MUST be less than 30 days old)

GST Return Filing - an Overview

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India. Every taxpayer registered under GST has to file GST returns. These returns are used to calculate the tax liability by the government. GST is an evolving system of taxation and the government keeps updating the rules and regulations around it. So, it is important to stay up-to-date to be able to file your returns correctly.

Our GST return filing service helps taxpayers like you to get it done easily. Our professionals will take care of the filings so you don’t have to worry about staying up-to-date with laws or watching due dates.

GST Returns – Types and Due Dates

| GST Returns | Purpose |

|---|---|

| GSTR1 | Tax return for outward supplies made (contains the details of the interstate as well as intrastate B2B and B2C sales including purchases under reverse charge and inter-state stock transfers made during the tax period). If Form GSTR-1 is filed late (post the due date), the late fee will be auto-populated and collected in the next open return in Form GSTR-3B. From January 1, 2022, taxpayers will not be permitted to file Form GSTR-1 if they have not filed Form GSTR-3B in the preceding month. |

| GSTR1A | An amendment form that is used to correct the GSTR-1 document including any mismatches between the GSTR-1 of a taxpayer and the GSTR-2 of his/her customers. This can be filed between 15 and 17 of the following month. |

| GSTR2 | Monthly return for inward supplies received (contains taxpayer info, period of return and final invoice-level purchase information related to the tax period, listed separately for goods and services). |

| GSTR2A | An auto-drafted tax return for purchases and inward supplies made by a taxpayer is automatically compiled by the GSTN based on the information present within the GSTR-1 of his/her suppliers. |

| GSTR2B | GSTR 2B is an auto-drafted document that will act as an Input Tax Credit (ITC) statement for taxpayers. The GST Council states that GSTR 2B will help in cutting down the time taken to file returns, minimise errors, ease reconciliation and simplify compliance. |

| GSTR3 | Consolidated monthly tax return (contains The taxpayer’s basic information (name, GSTIN, etc), period to which the return pertains, turnover details, final aggregate-level inward and outward supply details, tax liability under CGST, SGST, IGST, and additional tax (+1% tax), details about your ITC, cash, and liability ledgers, details of other payments such as interests, penalties, and fees). |

| GSTR3A | Tax notice issued by the tax authority to a defaulter who has failed to file monthly GST returns on time. |

| GSTR3B | Temporary consolidated summary return of inward and outward supplies that the Government of India has introduced as relaxation for businesses that have recently transitioned to GST. Hence, in the months of July and August 2017, the tax payments will be based on a simple return called the GSTR-3B instead. |

| GSTR4 | Quarterly return for compounding vendors (It contains the total value of supply made during the period covered by the return, along with the details of the tax paid at the compounding rate (not more than 1% of aggregate turnover) for the period along with invoice-wise details for inward supplies if they are either imports or purchased from normal taxpayers). |

| GSTR4A | Quarterly purchase-related tax return for composition dealers. It’s automatically generated by the GSTN portal based on the information furnished in the GSTR-1, GSTR-5, and GSTR-7 of your suppliers. |

| GSTR5 | Variable return for Non-resident foreign taxpayers (It contains the details of the taxpayer, period of return and invoice details of all goods and services sold and purchased (this also includes imports) by the taxpayer on Indian soil for the registered period/month). |

| GSTR6 | Monthly return for ISDs (This return contains the details of the taxpayer’s basic information (name, GSTIN, etc), period to which the return pertains, invoice-level supply details from the GSTR-1 of counter-parties, invoice details, including the GSTIN of the taxpayer receiving the credit, separate ISD ledger containing the opening ITC balance for the period, credit for ITC services received, debit for ITC reversed or distributed, and closing balance). |

| GSTR7 | Monthly return for TDS transactions (This return contains the taxpayer’s basic information (name, GSTIN, etc), period to which the return pertains, supplier’s GSTIN, invoices against which the tax has been deducted (categorized under the major tax heads – SGST, CGST, and IGST), and details of any other payments such as interests and penalties). |

| GSTR8 | Monthly return for e-commerce operators (It contains the taxpayer’s basic information (name, GSTIN, etc), the period to which the return pertains, details of supplies made to customers through the e-commerce portal by both registered taxable persons and unregistered persons, customers’ basic information (whether or not they are registered taxpayers), the amount of tax collected at source, tax payable, and tax paid). |

| GSTR9 | Annual consolidated tax return (It contains the taxpayer’s income and expenditure in detail. these are then regrouped according to the monthly returns filed by the taxpayer). |

| GSTR9A | Annual composition return form that has to be filed by every taxpayer who is enrolled in the composition scheme. |

| GSTR9B | Annual return form that has to be filed by e-commerce operators who collect tax at the source. |

| GSTR9C | Audit form that needs to be filed by every taxpayer who is liable to get their annual reports audited when their aggregate turnover exceeds Rs. 2 crores in a financial year. |

| GSTR10 | Final GST returns before cancelling GST registration (This final return is to be filed when terminating business activities permanently/cancelling GST registration. It will contain the details of all supplies, liabilities, tax collected, tax payable, etc). |

| GSTR11 | Variable tax return for taxpayers with UIN (It contains the details of purchases made by foreign embassies and diplomatic missions for self-consumption during a particular month). |

Steps to file GST Returns Online

The government has been making strides towards innovation and automation and has instituted facilities for the online filing of GST returns on the government’s GST portal, through the Goods and Service Tax Network (GSTN).

- Step 1: Go to the GST portal – www.gst.gov.in

- Step 2: Obtain a 15-digit GSTIN (GST Identification Number), which is issued based on your state code and PAN

- Step 3: Upload the relevant invoices on the GST portal. An invoice reference number against each invoice will be allotted to you

- Step 4: Once all the invoices, inward returns, outward returns, and cumulative monthly returns are uploaded, verify all the data you have inputted and file your returns.

With Finnsdom, you can do your GST filing with a few simple steps. Finnsdom is well-known for its user-friendly online platform with which you can avail of GST filing services from the comfort of your home. The dedicated representatives of Finnsdom will be in constant touch with you right from the word go. They will collect from you all the documents required and do the needful.

Types of GST Return Application Status Tracking

The status of the GST return application depends upon the performance of the obligation, and the status available would make the taxpayer aware of their filing.

FILED-VALID: When the return is being filed by the registered taxpayer and has fulfilled all the requirements

FILED-INVALID: When the tax is partly or fully remains unremitted

TO BE FILED: Return is due but has not been filed

SUBMITTED BUT NOT VALID: In cases where the return has been validated but the filing is pending.

Ways to Check GST Returns Status

- Through Application Reference Number (ARN)

- By selecting the Return Filing Period or

- By selecting the Status Option.

When Tracking Through ARN

When submitting the tax return, taxpayers are allotted a unique number called an ARN number which helps in tracking the status of the tax return which is to be done every month. Steps to view the status through ARN are:

Step 1: Visit the official GST portal and log in to your user portal by filing down the required credentials or entering the valid details

Step 2: Click of the Services>Returns>Track Return status

Step 3: Enter the ARN number which been sent to the registered e-mail address of the taxpayer and click on the search command.

On clicking on the search option, there would be a full display of the return application status which will be having all the relevant details.

When Tracking through Return Filling Period

Step 1: Visit the official GST portal and log in to your user portal by filing down the required credentials or entering the valid details

Step 2: Click of the Services>Returns>Track Return status

Step 3: Click on the Return Filling period and enter the dates with the help of the calendar available. Click on the search option

On clicking on the search option all the relevant details would be displayed on the screen.

When Tracking Through the Status

Step 1: Visit the official GST portal and select the search taxpayer option.

Step 2: You will see GSTIN/UIN option, enter your GSTIN ID and fill in the exact captcha code and then click on the search command. Captcha Code will appear only when you will enter your GSTIN ID.

Once all of the information is submitted, the page will display all of the relevant information about the company, including the legal name, jurisdiction, date of registration, GSTIN/UIN status, and data from all recent GST returns filed under various sub-headings.

Steps to Download GST Returns Online

Here is a step by step guide on how to download the GST returns online:

- Step 1: Enter your login details and click on ‘Login’

- Step 2: Click on ‘File Returns’

- Step 3: Select year and month, then click on ‘Search’

- Step 4: Click on ‘View GSTR 1’

- Step 5: Next click on ‘Preview’

- Step 6: Save in folder and right-click to show in folder.

Benefits of GST Return Filing

GST eliminates cascading effect

Earlier there were many instances where tax on tax was paid for a single transaction. As GST did away with several other taxes like central excise duty, service tax, customs duty, and state-level value-added tax, you no longer are subjected to paying tax on tax. This saves you money.

Higher threshold

The threshold for GST is aggregate turnover exceeding 40 lakhs for sale of goods and aggregate turnover exceeding 20 lakhs for sale of services. This means small businesses falling below this threshold limit are not subject to GST.

Easier for startups and e-commerce businesses

The GST system has made it easier for startups and e-commerce companies to manage their taxes. E-commerce particularly suffered from different tax laws across different states which are now eradicated by GST.

More organised system

Before GST the tax filing system was disorganised. Now, all taxes are paid online and major hassles that were a part of tax filing have been eliminated in the process of introducing GST.

Documents Required

- Invoices issued to persons with GSTIN or B2B invoices.

- Invoices issued to persons without GSTIN or B2C invoices. This needs to be submitted only when its total value is above 2.5 lakhs.

- A consolidation of inter-state sales.

- HSN-wise summary of all goods sold.

- Any other debit or credit notes or advance receipts.

Why Finnsdom?

- You don’t want to worry about keeping tabs on due dates, we will remind you

- Simplified system to keep your invoices and other documents in place and organised

- Experts file your returns and ensure you get a proper input tax credit and save money

- No more trying to make sense of changes in GST laws and processes, our experts file returns for many other businesses like yours and are always up to date with it

- Your filing with be error-free and you will save a lot of time and effort

- We bear any sort of penalties incurred due to any erroneous delay from our end.

The Glossary

GST Payment for Different Taxpayers

The GST payment process is largely the same for all taxpayers. Payment is not required if the electronic cash ledger has a sufficient cash balance. In other words, if the cash balance is insufficient, the taxpayer must utilise a challan to deposit money into the cash ledger using prescribed payment methods. The following is an overview of the payment process for various taxpayer types:

Regular Taxpayer

Around the time of submitting GSTR-3B, they must use the PMT-06 challan to make any GST payments to the electronic cash ledger. The details will be published in GSTR-3B. They can also generate a challan and pay for it before or after logging in, or while completing GSTR-3B returns.

Quarterly Taxpayer

These are taxpayers who have chosen to participate in the GST QRMP scheme. They must deposit tax directly utilising the PMT-6 in the first two months of a quarter and make payment while filing GSTR-3B in the last month of the quarter.

Taxpayers Filing Nil GST Returns

For the relevant tax period, whether for the month or quarter, these taxpayers have no sales or purchases, and no tax is due. They don’t have to use the challan or pay anything.

Composition Taxable Persons

These taxpayers must total up their sales/turnover information for the quarter in challan CMP-08 and pay the tax.

Steps for Online GST Payment

To make the GST payment post-login to the GST Portal once the challan is generated, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed

- Login to the GST Portal with valid credentials

- Access the generated challan. Click the Services > Payments > Challan History command

- Select the CPIN link for which you want to make the payment

Note: In case you don’t know the CPIN number, you can select the Search By Date option to search the CPIN number by the date on which it was generated.

- Select the Mode of E-Payment

- In the case of Net Banking

- Select the bank through which you want to make the payment

- Select the checkbox for terms and conditions to apply

- Click the make payment button

- In the case of Credit/ Debit Cards

- Please select a payment gateway, select the payment gateway option

- Select the checkbox for terms and conditions apply

- Click the make payment button

Steps for Offline GST Payment

In the case of Over the Counter

- In the payment modes option, select the over the counter as a payment mode

- Select the name of the bank where cash or instrument is proposed to be deposited

- Select the type of instrument as cash/cheque/demand draft

- Click the generate challan button

- Take a printout of the challan and visit the selected Bank

- Pay using cash/cheque/demand draft within the challan’s validity period

- The status of the payment will be updated on the GST Portal after confirmation from the bank.

Steps for GST Payment Through NEFT/RTGS

In the case of NEFT/ RTGS

- In the payment modes option, select the NEFT/RTGS as a payment mode

- In the remitting bank drop-down list, select the name of the remitting bank

- Click the generate challan button

- Take a printout of the challan and visit the selected Bank. Mandate forms will also be generated simultaneously

- Pay using Cheque through your account with the selected bank/branch. You can also pay using the account debit facility

- The transaction will be processed by the bank and RBI shall confirm the same within <2 hours>

- Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS CPIN on the GST Portal. Go to challan history and click the CPIN link. Enter the UTR and link it with the NEFT/RTGS payment

- The status of the payment will be updated on the GST portal after confirmation from the bank

- The payment will be updated in the electronic cash ledger in respective minor/major heads.

Penalty On Late Payment Of GST

When you miss the due date for returns, a late fee of ₹50/day (₹25 each for CGST and SGST) is to be paid if you have a tax liability. If you don’t have tax liability the late fee is ₹20/day. ₹5000/- is the cap on the late fee. In case of delay in annual return filing (GSTR-9), the late fee is ₹200/day (₹100 each for CGST and SGST).

GST Return Filing Glossary

CGST

It is the tax collected by the central government on intra-state sales.

SGST

The tax collected by the state government on intra-state sales.

IGST

The tax collected by the central government for an inter-state sale.

UGST

Union Territory Goods and Services Tax – A part of GST which is levied by the Union Government.

GSTIN

Goods and Services Tax Identification Number/GST registration number is a unique 15-character identity number given to the businesses that register for GST.

GSTR

GST Return (GSTR) is a document capturing the details of the income, which a taxpayer is supposed to file with the authorities to calculate his tax liability. There are a total of 11 types of GST returns.

GSTN

Goods and Services Tax Network (GSTN) is a non-profit, public-private partnership company that provides IT infrastructure and services for the implementation of GST.

ITC

Input tax credit [ITC] is the credit a taxable person receives for paying input taxes towards inputs used for his business.

GST Invoice

The GST invoice is issued by the person who is supplying goods and services. It includes the details of the sale and the seller’s GSTIN.

HSN Code

HSN code is a 6-digit uniform code that classifies 5000+ products and is accepted worldwide. HSN stands for Harmonized System of Nomenclature.

SAC Code

SAC code is a code used to classify services under GST. Each service has a unique SAC code.

Aggregate turnover

Aggregate turnover is the total value of all taxable supplies and it is used to determine the threshold for GST.

Taxable person

A taxable person is any individual engaged in economic activity in India and who is or is required to be registered under GST.

GST Compliance Rating

GST Compliance Rating is a score between [0 -10] assigned to all the taxpayers, that depicts their GST compliance.

Quick Links

- Online GST Registration

- GST Return Fiing

- GST Types

- GST Advisory

- GSTIN

- GST for Individual

- GST Payment and Refund

- GST Return Forms

Get Started at

₹ 499/-

FAQ's on GST Filing

The QRMP scheme applies to registered taxpayers who have an aggregate turnover equal to or less than ₹5 crores in the previous financial year. Under this scheme, businesses will be allowed to file returns every quarter instead of every month. Taxes have to be paid every month.

Yes, the process for GST registration is online completely. You can do everything in the personalised dashboard we provide for you.

No. The threshold for northeastern states (special category states) is lesser than other states. There the threshold is ₹20 lakhs for the sale of goods and ₹10 lakhs for the sale of services.

Yes, GST has to be paid every month on its due date. You first pay GST and then file returns.

It is not possible to revise the GST returns. That is why it is advised to get professionals to file your returns. Changes can be made to the details provided in the next period’s return form amendment section.

We ensure that all your returns are filed on time and no delays happen as long as you provide us with all the details and documents in time. If there is an erroneous delay on our part, we will bear the late fees for the same.

It is mandatory to file GSTR-1 each month for every registered taxpayer. On the other hand, if you opt for the QRMP scheme, you have to file quarterly returns only.

EWay Bill is an Electronic Waybill a GST registered person should get for movement of goods in a vehicle whose value exceeds ₹50,000. You can do e-Way bill registration through the e-Way Bill Portal (https://ewaybillgst.gov.in/).