Nidhi Company Registration

“Nidhi” is a Hindi word, which means finance or fund. Nidhi Company Registration is done with an intention to cultivate savings among members and to provide finance among members only. It is allowed to take loans from members and can lend to only members. Hence, it can not accept deposits or lend from/to non-members.

Who Should Register For A Nidhi Company?

It’s ideal for those businesses looking to start a permanent and a mutual benefit fund, or a mutual benefit company.

Register Your Nidhi Company Now

Documents Required from Directors, Shareholders

- Pan Card Copy (Mandatory)

- ID Proof (Any one) – Driving License/ Voter ID/ Passport Copy/ Aadhaar Card

- Address Proof – Latest Bank Statement/ Latest Telephone or Mobile Bill/ Latest Electricity Bill.(MUST be less than 30 days old)

- Passport Size Photograph

Documents Required for Registered Office Address

- NOC – No Objection Certificate from the Owner of the Property

- Address Proof – Latest Telephone Bill or Mobile Bill/ Gas Bill/ Electricity Bill (MUST be less than 30 days old)

What is a Nidhi Company?

It is a company classified as an NBFC (a Non-banking financing company) and registered under Section 406 of Companies Act, 2013. The main business of such a company is to facilitate lending money between the core members of the company. This way members (or shareholder) are encouraged to save money and invest them within the company. These deposits are then used by the company for its members (or shareholder), to provide loans or advances, and to acquire government-issued stocks/bonds/debentures/securities. It is regulated by the Ministry of Corporate Affairs, while the RBI monitors all its financial dealings.

Benefits of a Nidhi Company

Cheaper To Borrow:

As a member, one can borrow money at a minimum rate, relative to the rate at which banks lend money. This can be a major advantage in times of need, as different individuals in the mutual benefit society are likely to need funds at different points in time.

Encourages Savings:

It encourages all its members to save money and encourages a thrifty lifestyle. A Nidhi Company, after all, is a mutual benefit society wherein members can lend or borrow money and accept financial aid amongst them.

Fewer Complications:

Borrowing and lending to known persons, where the procedure is fixed, is much less complicated than dealing with banks or in an informal setting. A Nidhi Company enables its members to unlock the potential of their money and gain from lower interest rates when they require money themselves.

Checklist For A Nidhi Company

- At least seven members are mandatory to form a Nidhi company. Out of these, three should be designated as the directors. However, it should acquire a minimum of 200 members within one year of commencement.

- Moreover, the company should have a minimum equity share capital of Rs 5 lakhs, for registering as a Nidhi Company. This entire amount has to be paid up. However, the Net Owned Funds (NOF) must be increased to Rs 10 lakhs within a year of registration.

- a.At least 10% of its outstanding deposits should comprise of un-encumbered term deposits.

- b.The prescribed NOF to deposits ratio should be 1:20.

This includes equity share capital and free reserves and excludes accumulated losses as well as intangible assets. - At least 10% of its outstanding deposits should comprise of un-encumbered term deposits

- The prescribed NOF to deposits ratio should be 1:20. where 10% of the total deposits are in a fixed deposit account of a nationalized bank.

What are the 10 things Nidhi Companies cannot do as an NBFC (Non-Banking Financial Company)?

A Nidhi company cannot deal in the following –

- Chit fund business

- Hire purchase finance

- Acquisition/insurance of securities issued by any corporate

- Engaging as an NBFC in the business of advances or loans

- Leasing finance

- Acquisition of stocks/shares /bonds/securities/debentures issued by any local authority /Govt./marketable securities

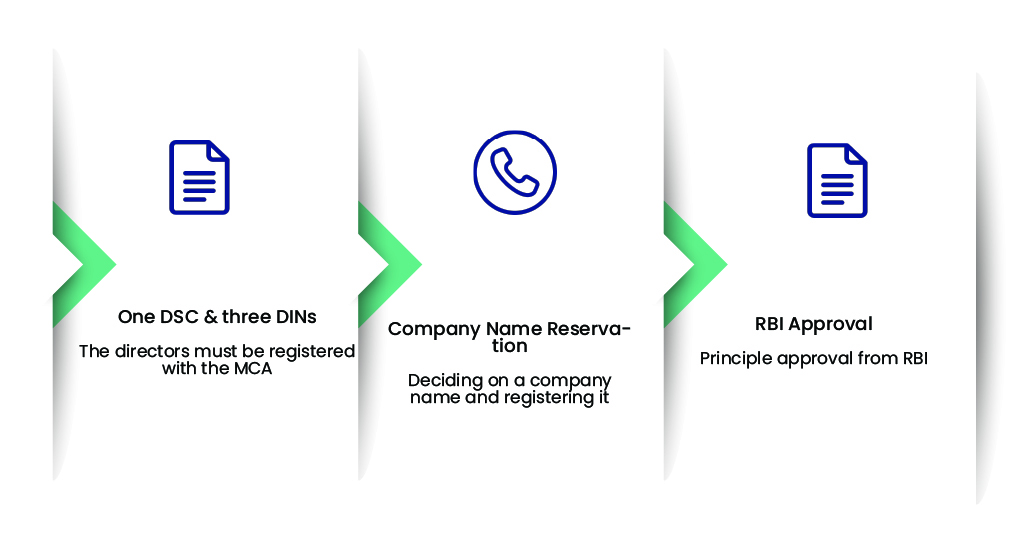

Finnsdom Procedure for Nidhi Company Registration

Contrary to what you might think, registering a Nidhi Company is a simple 3-Step process and can be done completely online. We’ve laid it out below.

- Name Reservation – We help you reserve your name with MCA.

- DSC and DINs – We help you get 1 DSC and 3 DINs.

- Documents and approval – We help you at every stage of the documentation process and in getting in-principle approval from the RBI.

Documents Required for Nidhi Company Registration

To Be Submitted By All Directors

- Self-attested copy of PAN Card

- Self-attested copy of Driver’s License/ Voter ID/ Aadhaar Card/Passport

- Self-attested copy of Electricity Bill

- Passport-size Photograph

- Specimen Signature Certificate

Why Finnsdom?

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfill all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

So you can start your Nidhi company registration process at ₹499/-.

Get Started at

₹ 499/-

FAQ's On Nidhi Company

A minimum of three branches can be opened in a particular district. In case you want to expand outside the district or want to open more than three branches, the Registrar of Companies need to intimated 30 days prior to their opening.

No, members are only allowed to deposit, borrow, or lend funds.

A Nidhi Company can accept deposits not exceeding 20 times of its net owned assets, as per the last audited statements.

The conditions laid down by the Act says that a Nidhi Company should acquire a minimum of 200 members within its first year of incorporation. However, in case the company is not able to meet the required numbers, it can apply for an extension with the necessary government authorities.

Any person can deposit, lend or borrow money through the provisions provided by the Companies Act, 2013. Hence, they can all become members of a Nidhi Company. provided they are not a corporation or a company.