Apply For Import Export Code

Connect with an experienced and trusted Professionals in minutes. No need to wait weeks for appointments and no outrageous fees involved. Seek legal advice from industry legal experts and start the registration at just ₹499.

Import Export Code Steps

We will help you get your IEC in just 3 days!

Apply For Import Export Code

Documents Required from Directors, Shareholders

- Pan Card Copy (Mandatory)

- ID Proof (Any one) – Driving License/ Voter ID/ Passport Copy/ Aadhaar Card

- Address Proof – Latest Bank Statement/ Latest Telephone or Mobile Bill/ Latest Electricity Bill.(MUST be less than 30 days old)

- Passport Size Photograph

Documents Required for Registered Office Address

- NOC – No Objection Certificate from the Owner of the Property

- Address Proof – Latest Telephone Bill or Mobile Bill/ Gas Bill/ Electricity Bill (MUST be less than 30 days old)

Documents required for Business

Entity

- Registration certificate

- Light Bill/ Gas bill of address

- Noc- No objection certificates from owner of property

- Cancelled cheque

- Other certificates if any

Import Export Code Registration - an Overview

An import-export code is a unique 10-digit code required for every import/export business owner in India. The code is issued by the Director-General of Foreign Trade (DGFT), Ministry of Commerce, and needs no filing or renewal. Importers require IEC to clear customs and shipment and transfer money to foreign banks. Exporters require their IEC to send shipments and receive money from foreign banks. In short, no importer/exporter can operate in India without getting the IEC.

Benefits

- The IEC registration helps traders open the doors to venture into the global market, including registration in online e-commerce operators

- Businesses can avail government schemes like the Merchandise Export from India Scheme (MEIS), the Service Export from India Scheme (SEIS), and others from customs and export promotion

- No compliance requirements pos registration and hence maintaining the business is relatively simple

- The process of obtaining IEC is not tedious and can be obtained with minimal, basic documents.

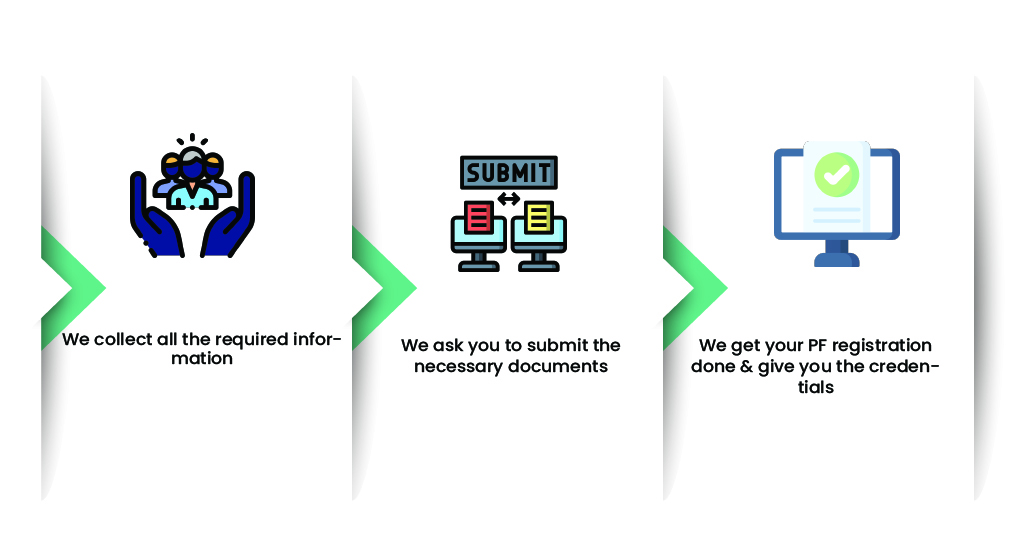

How to Register for an IEC

To get your import export license online, you will need to do the following simple IEC registration steps.

- Step 1: All the required documents, including bank details and DSC, have to be submitted

- Step 2:The online IEC application form will be filed with the Directorate General of Foreign Trade (DGFT)

- Step 3: Once the documents and application are verified by the authorities, the import-export code will be granted as a soft copy to the entity.

Documents Required

The documents required for an IEC registration are relatively easy to get together. Only a few documents are required, which are listed below.

- PAN Card of the company (not applicable in the case of the proprietor)

- Applicant’s PAN and Aadhaar card (driving license/Aadhaar/voter ID)

- Incorporation certificate/partnership deed

- Address proof (electricity bill/rent agreement/sale deed of the office location)

- Copy of cancelled cheque leaf/banker certificate of the current account in the name of the company.

Eligibility

Any type of business registration: sole proprietorship, partnership, private limited companies, charitable organizations dealing with import and exports of goods can register for import-export code, irrespective of the size. However, an IEC is not required for the import/export of goods for personal use, which is not connected with trade, manufacture, or agriculture. There is no need for a business set-up.

Exemption of IEC

- Persons undertaking import and export of goods for personal reasons and not connected to trade, agriculture and manufacture

- Through Indo-Myanmar border areas and China (via NamgayaShipkila, Gunji, and Nathula ports), the parties/individuals who import/export goods to/from Nepal and Myanmar with a single consignment must not exceed the value of ₹25,000

- As listed in appendix – 3, schedule 2 of ITC, exemption from obtaining IEC shall not be applicable for the export of materials, organisms, special chemicals, equipment & technologies (SCOMET)

- Ministries/departments of central and state governments.

Commercial public sector undertakings (PSU) who have obtained PAN will, however, be required to obtain the import-export code number. The permanent IEC number as mentioned above shall be used by non-commercial PSUs.

Why Finnsdom?

- Our experts will guide you throughout the process, from filling up the checklist to processing the documents

- We’ll keep you informed about the status of your application

- Our experts will complete the import export code registration process smoothly and at the best rates

- The entire procedure with us takes approximately 10 days

- We will assist you in obtaining your import export licence online.

Importer Exporter Code Glossary

AES: Automated Export System

The automated export system (AES) is the system used by U.S. exporters to electronically declare their international exports to the census bureau to help compile U.S. export and trade statistics.

FTR: Foreign Trade Regulations

Trade regulation is a field of law, often bracketed with antitrust, including government regulation of unfair methods of competition and unfair or deceptive business acts or practices.

POA: Power of Attorney

A power of attorney or letter of attorney is a written authorization to represent or act on another’s behalf in private affairs, business, or some other legal matter. The person authorizing the other to act is the principal, grantor, or donor (of the power). The one authorized to act is the agent or, in some common law jurisdictions, the attorney-in-fact.

Get Started at

₹ 499/-

FAQ's On Import Export Code Registration

IEC stands for import export code which is a 10 digit number issued by the director general of foreign trade, department of commerce, government of India. It is a registration required for traders importing or exporting goods and services to or from India.

IE code is not a tax registration. However, certain customs duty may be levied depending on the product.

Anyone who is acting as sole proprietor of a business can obtain IE code registration.

Any person/company dealing in international trade of export and import of goods and services need to register for IE code.

No. IEC is a mandatory document for recognition by the govt. of India as exporter / importer of goods and services. However, if the value of goods is too low, the customs authorities may permit first export by imposing nominal charges which is highly unlikely to happen.

To obtain IE code registration, a copy of PAN card and Aadhaar card, proof of address of business and constitution of the business [partnership deed, incorporation certificate, etc.,] and a cancelled cheque of the current account is required.